Article de Marie-Astrid Humbert (EnvIM 2022)

Introduction

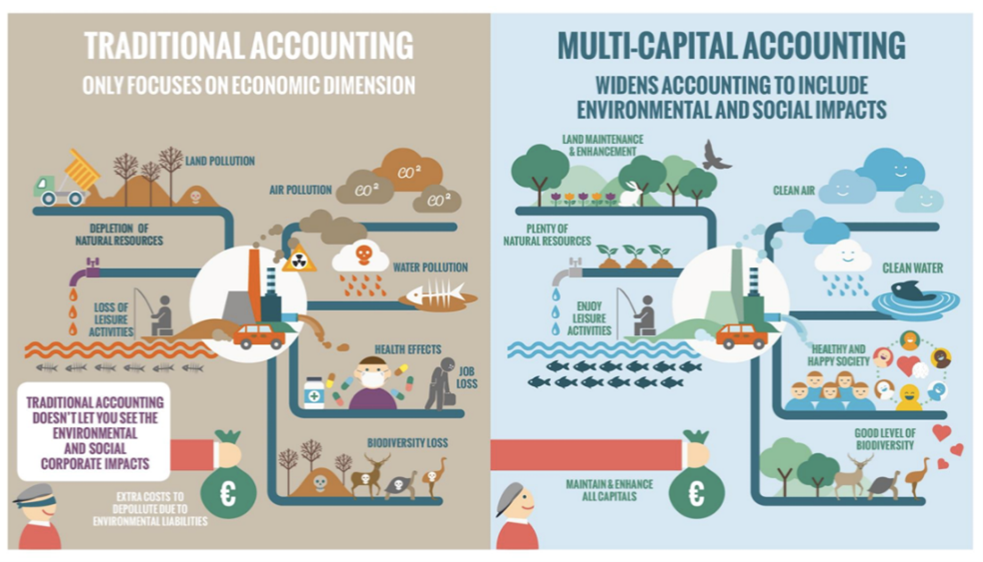

According to Lord Kelvin “when you can measure what you are speaking about, and express it in numbers, you know something about it” (1883), which suggests that data drives knowledge and management. Organizations and especially companies are currently facing increasing pressure to show they contribute positively to society while generating profits for shareholders. However, contrarily to “traditional” accounting which solely focuses on the economic dimension and has robust norms that have evolved according to companies’ needs (Colasse et al, 2022), the value of other capitals including natural and human one is not considered in accounting.

The development of a legal framework for non-financial reporting is fairly recent. The disclosure of social and environmental information has become mandatory in Europe with the implementation of the Non-Financial Reporting Directive (“NFRD”) 2014/95/EU. Large companies, both listed and unlisted, must publicly provide non-financial information on a yearly basis (incl. business models, policies adopted regarding non-financial issues, non-financial KPIs, outcomes of adopted policies, and related risks). However, environmental and social statements are presented separately from financial ones and without linking them one to another.

In order to monitor and manage an organization’s overall impact, a multi-capital approach is required to firstly gain data robustness and secondly create information that is reliable, comparable and verifiable (C3D – ORÉE – ORSE, 2021). In addition, the aim of such approach is to measure the externalities and tend towards their internalization while outlining the complexity of these challenges and making sense at a company level.

With this in mind, we may wonder to what extent the integration of human and natural capital into traditional accounting can participate in the paradigm shift and sustainable transition of companies? What are the existing tools to carry out multi-capital accounting? How to scale up and mainstream these practices?

Historical components of an integrated accounting approach

The integrated accounting models suggest that in addition the economic aspect, other forms of accounting are grouped together. The other forms covered are the human and natural dimensions. Even though this approach could be considered as anthropocentric, from the point of view of human needs, it nevertheless seems to be more inclusive than the traditional accounting.

- What is human capital?

Human capital refers to “human beings and their attributes, including physical and mental health, knowledge, and other capacities that enable people to be productive members of society” (Costanza et al, 2013). It therefore implies that basic human needs are to be fulfilled, such as “satisfying employment, spirituality, understanding, skills development, creativity, and freedom” (Costanza et al, 2013). These capabilities can be improved through education, training, and health.

- What is natural capital?

While nature refers to life in general, natural capital is associated to “ecosystemic services”. Therefore, it designates the natural environment and its biodiversity that is needed to provide the ecosystem goods and services “essential to basic human needs such as survival, climate regulation, habitat for other species, water supply, food, fiber, fuel, recreation, cultural amenities, and the raw materials required for all economic production” (Costanza et al, 2013). Natural capital is a human-centered and utilitarian concept associated to David Pearce who illustrated the role of nature “as a stock of natural assets serving economic functions” (1988) and contributing to human welfare.

Other conceptions of natural capital in accounting have arisen more recently, with on the one hand the research on “assertization” (an asset that is monetarized) and on the other hand the work on accountability rather focused on reparability. These two conceptions of asset versus liability are still a common debate (Rambaud and al, 2015).

- Tensions between weak and strong sustainability

In addition, two visions of natural capital are coexisting: the “weak sustainability” versus the “strong sustainability” (Neumayer, 2003).

- The first paradigm shares a utilitarian vision which consists in ensuring that “what matters for future generations is only the total aggregate stock of ‘man made’ and ‘natural’ capital (and possibly other forms of capital as well) and not natural capital as such”. Therefore, if robots carried out pollination because bees were to go instinct, it would not pose a problem as long as the aggregate value of the capital stock was maintained.

- In opposition to this, the relational view of strong sustainability defines natural capital as non-substitutable “both in the production of consumption of goods and as the direct provider of utility”. Strong sustainability introduces the concept of planetary boundaries.

In other words, the weak sustainability stipulates that each capital (economic, human, and natural capital) is interchangeable and substitutable, whereas each capital is indivisible in the strong sustainability paradigm.

- The Triple Bottom Line

Converging agendas between transformation of accounting models and debates on the modes of sustainability, some frameworks have emerged to improve the current accounting model. In the 90s, John Elkington theorized the so-called “triple bottom line” (TBL) approach for companies (1998). It suggests a simultaneous focus on economic, social, and environmental concerns, also called the 3Ps – profit, people and planet. The TBL aims to measure the financial, social, and environmental performance of a company over time and requires a business revolution on seven dimensions (“thinking in 7Ds”): markets, values, transparency, life-cycle technology, partnerships, time-perspective and corporate governance.

The extra-financial indicators proposed must allow a better understanding and control of organizations. It is challenging the traditional accounting model, but not willing to replace it entirely.

The organizations that are members of the World Business Council for Sustainable Development (WBCSD) wish to demonstrate the indispensable role of the private sector in promoting sustainable development, a concept that was originally political and macro-economic. They are experimenting valorization to put a price on natural capital so that it can be managed while minimizing externalities. This valuation of natural capital is at the heart of current debates on the construction of socio-environmental accounting models (Déjean, 2021).

This triple-capital approach was supported by the Global Reporting Initiative (GRI) which is an independent global sustainability standard setter founded in 1997 after the public scandal over the environmental damage of the Exxon Valdez oil spill. The GRI framework, which is now the benchmark for non-financial reporting, poses the question of the social and environmental externalities induced by economic activity. The recommendations on extra-financial indicators propose a complementary framework to the current accounting model (Colasse and al, 2022).

Towards a multi-capital approach

A set of alternative accounting models have emerged as levers to promote action and influence organizational decision-making towards ecological and social transition. The main question they tackle is the following: How can a new accounting system take into account all the elements that reflect the exact situation of the company?

Companies are gradually addressing this question and taking action. In France, an “integrated accounting” working group bringing together the C3D (Collège des Directeurs du Développement Durable), along with ORSE (Observatoire de la responsabilité sociétale des entreprises) and ORÉE presented five accounting methods co-constructed by researchers and companies in a dedicated guide:

- SeMA methodology (Sense Making & Accountability)

- Universal accounting methodology

- LIFTS model (Limits of Foundations Towards Sustainability)

- Triple Footprint Thesaurus method

- CARE model (Comprehensive Accounting in Respect of Ecology)

The three selected methodologies that will be detailed below are the most mature out of the 5 listed above and illustrate both ESG accounting and multi-capital accounting. They will provide an overview of the different methodological choices made, the assumptions and the level of complexity of each. How do these methodologies intend to measure an organization’s impacts and how do they intend to participate in the strong sustainability vision?

- LIFTS model: including the Doughnut theory at the company level

The Limits of Foundations Towards Sustainability (LIFTS) methodology was initiated by the Global and Multi-Capital performance research chair by Audencia. This multi-capital approach ensures sustainability that is consistent with planetary boundaries and social foundations. In addition, it is based on physical flows that can be converted into monetary and non-monetary units. It also supports the strong sustainability paradigm with non-substitutable capital where negative impacts that cannot be compensated by positive ones.

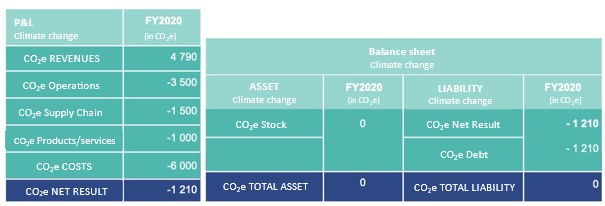

The LIFTS model refers to the Doughnut theory (Raworth, 2017) with the 9 planetary boundaries (the ecological ceiling) and 12 social thresholds (social foundations), but at an organization level. A company “budget” is allocated from the planetary and social “budget”. If it refers to the limit not to be exceeded, it is allocated as a stock (asset), if it refers to the foundations, it is allocated as a debt (liability). Each limit/foundation is measured by a physical indicator with its own balance sheet and P&L[1]. In the case of exceeded limit/foundations, it can easily be observed (see visual representation below).

[1] Profit and loss (P&L), also known as income statement refers to a financial report that summarizes a company’s revenues, costs, and expenses during a specified period.

To enforce this methodology according to each company, the relevant limit/foundations have to be prioritized and, if applicable, should all be covered and monitored over time. The results are presented thereafter per limit/foundation with an associated physical unit (ton of CO2e, €…) with its balance sheet and P&L:

The LIFTS model thus provides ESG KPIs, an ESG balance sheet and P&L, in parallel of a traditional balance sheet and P&L.

- Triple Footprint Thesaurus method: a new balance sheet and P&L integrating impacts on the whole supply chain

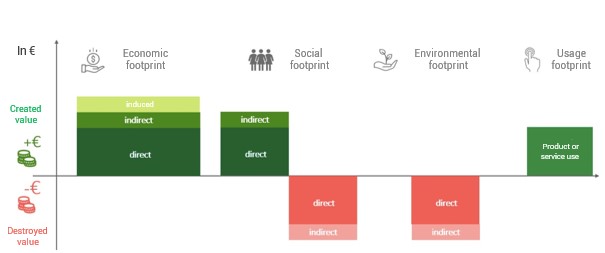

The Triple Footprint Thesaurus methodology was designed by the firm Goodwill-management. It aims at creating an ESG P&L and a new balance sheet. Results appear as complementary elements of these financial statements, with impacts that are assessed for the whole supply chain (with direct, indirect, and induced impacts) and through products and services market (use value). It also integrates planetary boundaries at the company level.

The new P&L incorporates economic, social and environmental flows caused by the company. It allows to translate positive and negative impact into economic value, including from the organization, its products and services, its supply chain and those related to household and public spending. It is therefore segmented as follows:

- Economic, social, environmental and usage footprints;

- Direct, indirect, induced and usage impacts;

- Value created versus value destroyed.

For environmental impacts, this methodology allows to calculate long term consequences of environmental degradation on the economy with prevention cost of each impact, i.e., lower than long term damage. Prevention costs are considered in regard to acceptable levels of impact of a company on the environment below which there is no need to act, which are the thresholds of harmlessness.

The new balance sheet comprises new extra-financial elements:

- In the asset section: intangible assets incl. customer capital, human capital, partner capital, knowledge capital, brand capital, organizational capital, information systems, shareholders, natural capital, and societal capital;

- In the liability section: societal, human, and natural capital debts.

A set of data are to be collected, such as environmental consumption of the company such as water, energy, soil or waste production, amount of purchase on the territory, wages, taxes, direct employment, social data (median male/female salary, breakdown of workforce by age and type of contract, workplace accidents), product and service usage metrics and other intangible data (brand awareness, number of patents, customer turnover).

Social impacts are computed in a set of categories: quality of life at work, job insecurity, sponsorship, professional integration, training, teleworking, gender pay gap and purchasing from the protected sector. Their quantification is challenging and involves methodological biases.

As for environment impacts, they are computed in varied categories: air pollution (M10, PM2.5, NOx, NH3, SO2, VOC), GHG emissions, land use and biodiversity, waste management, water pollution, extraction of fossil and mineral resources, water consumption. These data can be collected on a non-continuous manner, either with difference of scales or time, or even estimates.

The Triple Footprint Thesaurus method thus provides ESG KPIs, an ESG balance sheet and P&L, in parallel of a traditional balance sheet and P&L.

- CARE model: an integrated conceptual accounting framework

The CARE model (Comprehensive Accounting in Respect of Ecology) was developed by the CARE community, composed of scientists, academics, businesses, and NGOs, gathered around the “Ecological Accountability Chair” and CERCES.

This model conceptualizes natural and human “entity” as tangible liabilities that are used by the organization for its business model and that are independent from the organization’s activity and should be therefore maintained or enhanced. This vision is aligned with the strong sustainability approach.

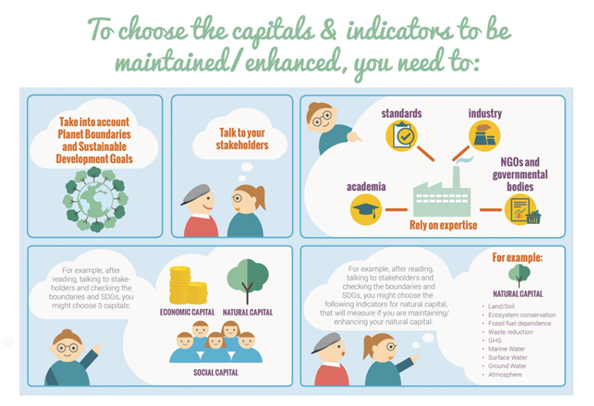

Its implementation in the organizations requires to define extra-financial capitals with an associated “preservation thresholds” which are scientifically validated (e.g. SBTi). To be integrated into the business model, each capital is associated with “impacts indicators” and “management indicators”, establishing a bio-physical accountability. It allows to monitor closely the capitals and anticipate whether a preservation threshold is exceeded, and thus implementing “preservation actions”. Because this method is applied along the value chain, an incoming and outgoing flows analysis is conducted to assess the impact for other stakeholders (e.g. supplier, clients). Each capital is therefore valued at a preservation cost.

Building on that, an integrated P&L, a balance sheet and an appendix are created. The latter integrates the definition of the chosen capitals, bio-physical information, and other elements on irreversible degradations. The final step corresponds to the integrated analysis to understand the overall performance of the company.

To exemplify this methodology with a case study, let’s take the example of Les Fermes d’Avenir. This association, which is part of the Groupe SOS, aims at accelerating the agroecological transition since 2013. In order to go further towards its sustainability commitments, it experimented the CARE methodology in 2016.

For this association, the CARE model enabled to differentiate organizations that contribute positively to the environment and society as the preservation of natural and social capital is to be reimbursed and appears in financial statements (including pollution, health cost, biodiversity, GHG emissions). More specifically, the capital and indicators selected for a multi-accounting farm are listed below:

| Economic capital | Environmental capital | Social capital |

| – Economic viability

– Financial autonomy – Economic stability – Woofing – Local economy |

– Land

– Ecosystem conservation – Enhancement and conservation of generic heritage – Fossil fuel dependence – GHG emissions – Waste management – Marine water – Fresh water – Atmosphere |

– Farm

– Quality of relationship within farm and ecosystem – Conservation of natural and cultural local heritage – Animal welfare – Health of society (through good food) |

Contrarily to the other methodologies, the CARE model thus provides an integrated balance sheet and P&L.

While the three methodologies are driven by academics (LIFTS), corporates (Thesaurus) or both (CARE Community), they have not been validated as such by a third party. They do not follow the same assumptions, application or results and aggregate several scientific, monetary, and non-monetary data.

Scaling up and mainstreaming these practices

All in all, the numerous existing methodologies show the growing interest of organizations to take up the issue, despite the complexity of the concepts used. It seems that, in order to accompany organizations in the ecological and social transition, redesigning accounting systems to have a genuine overview of overall performance is essential. Even though this paradigm shift may imply major transformations, it also creates strong opportunities: access to new markets, limitation of physical risks, brand image, attraction of talent, anticipation of regulations. This is why a growing number of forward-thinking companies and territories are already involved in projects to experiment with or perform these instruments aimed at strong sustainability.

All these methodologies align on their ambition to integrate as closely as possible the social and environmental conclusions, including science-based thresholds. Several questions arise on the feasibility of the approach, notably on the capacity to collect and analyze the data, on the interest of keeping a pragmatic approach in order not to lose sight of the objective, and on keeping a common language to compare the progress of each organization. Other questions arise on ethical point of view. Monetization of nature could be considered as a useful approach but is an anthropocentric approach. Indeed, it remains very questionable to put an economic value on nature and all the services it provides. For example, a forest provides different functions and renders different services such as it provides raw materials, captures CO2, improves air quality, manages rainwater, hosts biodiversity, protects in the city from noise and heat, or provides physical and mental well-being. How can a single data provide a just and fair value for all these “services”?

In addition, we may also wonder what are the obstacles and levers of such methodologies? If these tools which today are based on a voluntary approach by organizations were to become mandatory, would it be perceived as an additional reporting requirement or as a tool to sustainably transform organizations? Who should regulate and validate this common language? What concrete organizational situation can they change (internal carbon tax, investment decision-making tool…)?

–

Bibliography

Colasse, B. Déjean, F. (2022, Février). Représentation comptable de l’entreprise et développement durable. Alternatives Economiques. https://www.alternatives-economiques.fr/representation-comptable-de-lentreprise-developpement-durable/00102201

Costanza, R., Alperovitz, G., Daly, H. E., Farley, J., Franco, C., Jackson, T., Kubiszewski, I., Schor, J., & Victor, P. (2013). Building a sustainable and desirable economy-in-society-in-nature. ANU E Press.

C3D – ORÉE – ORSE. (2021, Novembre). La comptabilité intégrée, un outil de transformation des entreprises à la portée de tous. https://www.orse.org/file/535ed8c38476b32dc5a1aea25e0abecd.pdf (orse.org)

Déjean, F. (2021). Comptabilité et environnement : compter autrement. Annales des Mines – Responsabilité et environnement.

Elkington, J. (1998), Partnerships from cannibals with forks: The triple bottom line of 21st-century business

Fermes d’Avenir. (2019) Rapport d’Activité 2019 https://fermesdavenir.org/wp-content/uploads/2020/10/FERMES-DAVENIR-Rapport-dactivite-2019

Neumayer, E. (2003) Weak versus strong sustainability: Exploring the Limits of Two Opposing Paradigms

Pearce, D. (1988) Economics, equity and sustainable development. Futures.

Rambaud, A., & Richard, J. (2015). The “Triple Depreciation Line” instead of the “Triple Bottom Line”: Towards a genuine integrated reporting. Critical Perspectives on Accounting.

Kelvin L., Popular Lectures and Addresses (1883) vol. 1 ‘Electrical Units of Measurement