par Héloïse Dumont (EnvIM 2018)

In 2017, China has been the second largest green bond emitter following the United States of America according to the international organisation Climate Bond Initiative. There is currently a growing demand for more responsible investing all over the world, especially towards green finance, which is « the financing of investments that provide environmental benefits in the broader context of environmentally sustainable development, and will require tens of trillions of dollars in the coming decade » (Green Finance Progress Report 2017, United Nations Environment Programme, p. 13). As China has become one of the most powerful countries in the world, it is interesting to understand its green finance framework and how it is effective in China regarding environmental and social issues.

China’s current environmental and social issues

China is facing environmental, social and geopolitical issues regarding its global leading position. The country has tremendously changed within few decades, becoming the first global power in terms of GDP (Gross Domestic Product – 12,237.70 USD billions), in number of inhabitants (1,385.6 million inhabitants according to the Organisation for the Economic Cooperation and Development – OCDE), and in greenhouse gas (GHG) emissions (11,735 Mt CO2e, so 21.56% of global GHG emissions). China has become the « factory of the world », building its economic development on exports. Thus, pressure on resources has increased. It was followed by health and environmental problems, such as air pollution causing respiratory diseases or natural disasters. Considerable investments are therefore needed to finance a greener economy in China and to sustain simultaneously the economy, the society and the environment.

The government support to green finance

According to Dr. Ma Jun, chairman of China Green Finance Committee, “the Chinese government, the general public and financial institutions have vigorously supported green finance by introducing financial policies and encouraging product innovation” (How China became a global leader in green finance, Eco-Business, 9 April 2018).Indeed, more than only switching off factories periodically, the Chinese government has contributed to the rise of green finance including green bonds, green insurance and environmental credit trading. The transition has been initiated and supported by the government since the years 2009-2010. Indeed, China was one of the first countries to develop a compulsory Green Insurance System for all industries considered as highly polluting in 2009, firstly within the two provinces Guangdong and Jiangsu. According to the Chinese State Environmental Protection Administration (SEPA), more than 80% of the country’s largest chemical plants were located in sensitive spots regarding environmental issues in 2009. The government also launched the Green Credits Program the same year, allowing Chinese banks to withdraw from companies seen as major polluters and to offer credit to the best-in-class. Besides, the State Council approved in 2016 the “Guidelines for Establishing the Green Financial System” which tends to incentivize and promote green financial products and green funds as well as mandatory environmental information disclosure. This was the start of green finance in China. The government, both central and local, has then strengthened its policies and commitments especially in 2017, making green finance one of its top priorities. Indeed, during the 19th National Congress of the Communist Party of China (October 2017), which defines the vision and projects of the Communist Party for the next five years, the President Xi Jinping has engaged China in the building of an « ecological civilization », which includes the development of green finance. In June, the State Council set up five pilot zones (Guangdong, Guizhou, Jiangxi, Zhejiang and Xinjiang) to promote green finance. These pilot zones will enhance different programmes of green finance, such as green bond issuance or green loans. It shows therefore a strong will from the Chinese governement to green the financial system at all levels, including territorialisation and regulations.

Rising green finance

Nowadays, China seems to lead the global green finance market. China’s green bonds number increased by 278 per cent and by 28 per cent in value during the year 2017 (United Nations Environment Programme – UNEP). The same year, 7,826 green and low-carbon projects, corresponding to an investment of RMB 6.4 trillion (USD 0.96 trillion), have been listed in public-private partnerships catalogue. From UN Green finance progress report 2017, there is globally an increase of green finance especially since 2016, which includes an increase in funds, « policies, regulations, principles and fiscal incentives ». Following this report, three major trends have been identified: an increasingly systemic national action, a greater international cooperation and an increased market leadership at both individual and collective level. It is worth noting that the G20 (Group of Twenty), gathering global leading economies aiming at building strong sustainable and balanced growth, has included green finance into its agenda for the first time under the Chinese Presidency of 2016 within the Green Finance Study Group (GFSG), whose goal is to “develop options on how to enhance the ability of the financial system to mobilize private capital for green investment”. At the September 2016 Hangzhou Summit, G20 Heads of State identified seven broad financial sector options on voluntary basis for countries to achieve this goal, notably providing strategic policy signals and frameworks, promoting voluntary principles for green finance and expanding learning networks for capacity-building. According to the report, China has implemented all the key options and therefore developed a high potential for green finance at a global level, mostly through green bonds.

The potential of green bonds

A bond is a loan issued by an investor to an entity, usually to a corporate or to the government, which borrows the funds for a defined period of time at a variable or fixed interest rate. A green bond is a regular bond financing projects with environmental benefit. Usually, certified green bonds follow the Green Bonds Principles edicted by the International Capital Market Association (ICMA). The ICMA is a membership association committed to save the trust in the market, providing networks opportunities and encouraging information flows. They have four key-principles regarding sustainability assessment that are: Use of Proceeds, Process for Project, Evaluation and Selection, Management of Proceeds and Reporting. The certification is made by approved verifiers, such as Bureau Veritas or Climate Bonds Initiative. The project must have a clear environmental benefit that could be estimated or measured, ideally by a third-party auditor. The green bond emitter must communicate its analysis method and its environmental & social risk management to investors. Funds must be entirely dedicated to green projects and the emitter must report on this green-use. Initiated in 2007 by the World Bank, green bonds represent globally 0.2% of all bonds issued in the world, while it reaches 2% in China (USD 36.2 billion, China Green Bond Market 2016). These green projects could be renewable energy, clean transport or waste management ones. Green bonds require an independent review and frequent reporting. Green bonds are valuable in the way they increase the flow of long-term financing required for green infrastructure.

A bond is a loan issued by an investor to an entity, usually to a corporate or to the government, which borrows the funds for a defined period of time at a variable or fixed interest rate. A green bond is a regular bond financing projects with environmental benefit. Usually, certified green bonds follow the Green Bonds Principles edicted by the International Capital Market Association (ICMA). The ICMA is a membership association committed to save the trust in the market, providing networks opportunities and encouraging information flows. They have four key-principles regarding sustainability assessment that are: Use of Proceeds, Process for Project, Evaluation and Selection, Management of Proceeds and Reporting. The certification is made by approved verifiers, such as Bureau Veritas or Climate Bonds Initiative. The project must have a clear environmental benefit that could be estimated or measured, ideally by a third-party auditor. The green bond emitter must communicate its analysis method and its environmental & social risk management to investors. Funds must be entirely dedicated to green projects and the emitter must report on this green-use. Initiated in 2007 by the World Bank, green bonds represent globally 0.2% of all bonds issued in the world, while it reaches 2% in China (USD 36.2 billion, China Green Bond Market 2016). These green projects could be renewable energy, clean transport or waste management ones. Green bonds require an independent review and frequent reporting. Green bonds are valuable in the way they increase the flow of long-term financing required for green infrastructure.

Characteristics of Chinese green bonds in China

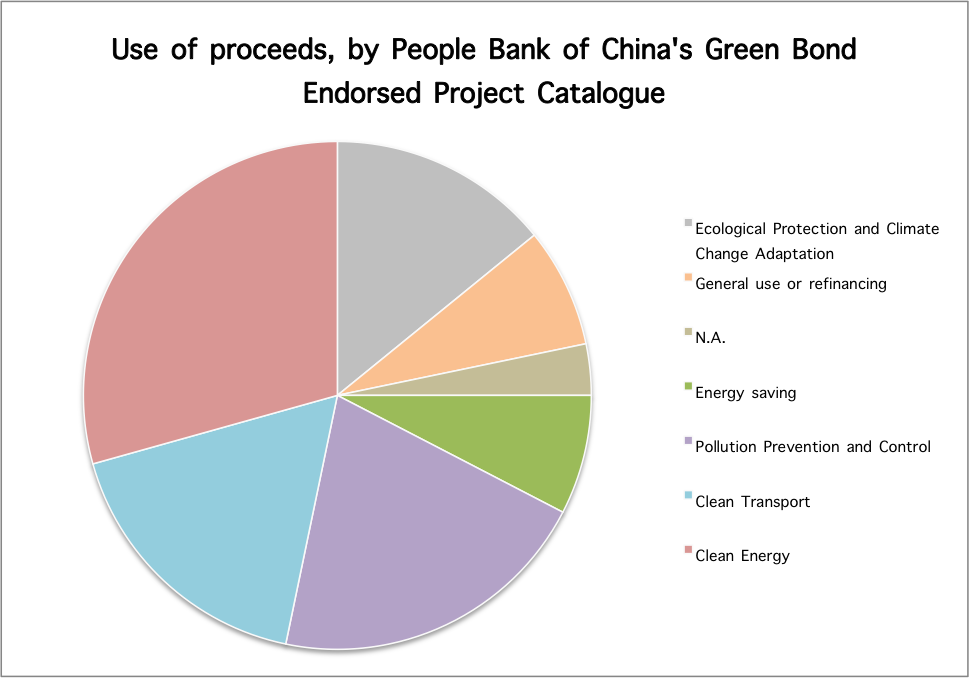

China entered the global green bond market in 2015. As China has made strong commitments regarding air pollution reduction, green bonds usually concerns Clean energy. In China, the average term of bank loans is only two years, which is far from what is required to finance longer-term green infrastructure projects. About 59% have a tenor shorter than five years whereas the majority of international bonds have a tenor between 5 and 10 years according to Climate Bond Initiative. In 2017, green bonds have been issued by Commercial banks and financial institutions (47%), Corporate (22%) Policy Bank (15%), Government-backed (10%) and Asset-Back Securities (ABS) (6%).

Investment grade green bonds concerns the majority of the green bond market, where most bonds are rated by local rating agencies. 17% of bonds do not have rating, but of this 14% were issued by China Development Bank or Agricultural Development Bank of China. Most of onshore issuance (meaning Chinese investment in China) carries ratings from local agencies, which is partly due to the fact that China’s credit rating market is not opened to foreign agencies yet. Most of offshore issuance (issued by foreign investors) has international rating agencies, mostly (58%) from the Big-Four accounting firms (Deloitte, EY, KPMG, PWC). Regarding domestic rating, which concerns 24% of issuance in 2017, Zhongcai Green Financing was the largest domestic green bond reviewer (by value). Moreover, 19% of green bonds do not have any external review. International ranking is expected to be more common in order to attract foreign investors. Moreover, reen bonds are usually Local Government Financing Vehicles (LGFV). In 2017, Local Government Financing Vehicles (LGFV) represented 10% of 2017 total green bond issuance from China (less than 1% in 2016). These Special Purpose Vehicles (SPV) are usually founded by local government authorities like municipalities to finance infrastructure projects. Enterprise bonds are the most common type of instrument used by LGFVs and are regulated by the China’s National development and Reform Commission (NDRC). As entreprise bonds are issued and backed by central government agencies, state-owned enterprises or state-controlled entities, the cost of borrowing is usually lower compared to regular corporate borrowers. Most of LGFV issued by the NDRC are green bonds, dealing with low carbon transportation and to water infrastructure, like the Xi’an Fengxi New City’s green bond raising funds for the electric vehicle charger stations.

Different frameworks

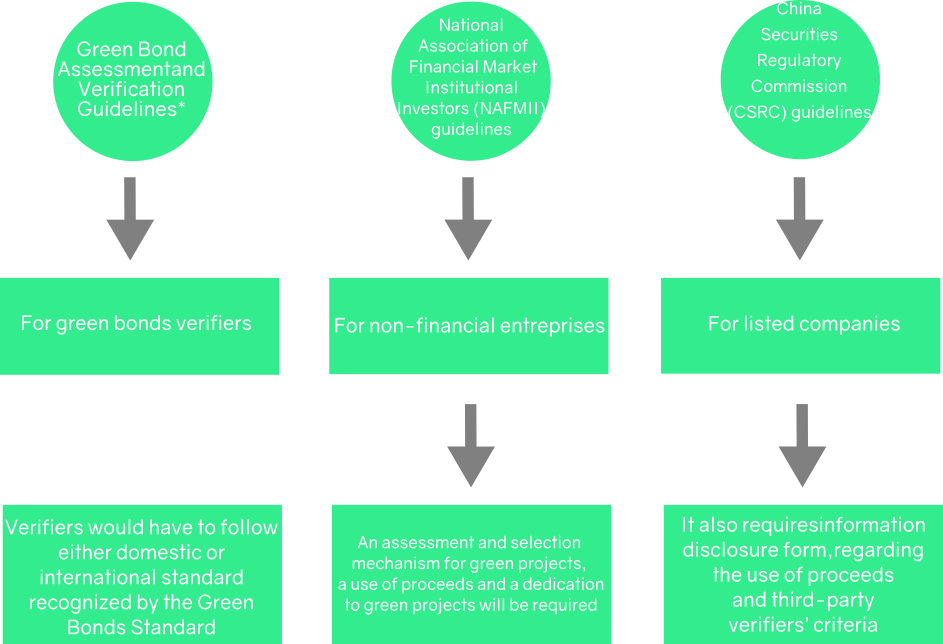

There are currently several guidelines in China, which have been issued in 2017 and tend to be harmonized following international standards. The following standards could be illustrated as follow:

Green finance guidelines in China

Nonetheless, small differences regarding qualifying projects could create confusion in the market. China is working to harmonise local green bond guidelines with those of international markets. In March 2017, People’s Bank of China (PBoC) and the European Investment Bank (EIB) developed a clear and common framework for analysis and decision-making in green finance. In November 2017, China’s Green Finance Committee, which operates under the PBoC, and the EIB issued a White Paper that provides an international comparison of several green bond standards. China has also announced a roadmap introducing compulsory environmental information disclosure requirement for listed companies which will be mandatory only for major polluters (2017); then semi-mandatory (2018) and mandatory for all (2020).

The pursuit of certification

In 2017, USD 22.3bn green bonds have been certified globally according to Climate Bond Initiative, representing 14% of the green bond market. The number of certified Climate Bond issuance is increasing, which is essential in order to maintain confidence in the market. In June 2017, China Three Gorges (CTG) became the first Chinese issuer to gain Climate Bonds Certification for a bond financing wind power projects raising € 650 million for wind projects in Germany and Portugal accounting for a combined installed capacity of 710MW. It was also the first Euro-denominate green bond issued by a Chinese corporate and was well received by foreign investors. Green bonds from Industrial and Commercial Bank of China, China Development Bank and Bank of China have also received Certifications in 2017. Certified Climate Bonds reached almost 16% of total green bond issuance from China in 2017.

Overestimation of Chinese green bonds

Despite this current trend toward harmonization, Chinese green bond market is currently overestimated according to Climate Bond Initiative. Indeed, green projects cover more projects in China, which are not considered as green following international standards. More than USD 14.2 bn green bonds were not in line with international green definitions in 2017. Contrary to international standards, green projects in China include retrofits of fossil fuel power stations, clean coal and coal efficiency improvements, electricity grid transmission infrastructure that carries fossil fuel energy, large new hydro projects (>50MW) and landfill waste disposal, etc. In China, bonds dedicated to fossil fuel assets generally includes coal efficiency features (for instance, the replacement of small coal-fired stations with a single new one). Even though these projects lead to a better efficiency, coal-related projects are not aligned with the steep emissions trajectory required to keep global warming within 2° C as stated in the Paris Agreement (2016).

Moreover, China’s National development and Reform Commission (NDRC) guidelines allow issuers to use up to 50% of proceeds to repay bank loans or invest in general working capital within green bonds (compared to 95% required by international guidelines). In 2017, USD 2.7bn (RMB 18bn) among USD 37.1bn green bonds did not meet the 95% threshold required internationally. This mismatch represents 38% among bonds seen as green by the NDPC (compared to 33% in 2016). Lastly, releasing information and third-party auditing are part of international standard. The gap between domestic green bonds and the international ones can generate skepticism about Chinese green bonds and distrust about their consistencies from foreign investors. There is actually a general risk of green washing with a questionable environmental benefit. This could lead to criticism even to divestment from foreign investors. China Three Gorges (CTG) green bond has been criticized. Nikkei Asian Review notably reported that Stephen Fitzgerald, co-founder of British green bond manager Affirmative Investment Management, considered that this project is an example of green washing which can mislead investors (Environmental bonds stained by ‘green washing’, Nikkei Asian Review, 3 March 2018). CTG, which is the largest hydropower entreprise in the world in terms of installed capacity has been criticized for water pollution and damage to the environment. This criticism emphasizes that the sustainability of an investment does not only rely on the project, but also on the operator. It gives value to company sustainability assessment in addition to project sustainability assessment.

Achieving sustainable economy

The green transition implies greater investments and needs, such as decreasing the pollution as well as the consumption of finite resources whereas increasing infrastructure. According to Climate Bonds Initiative and the United Nations Framework Convention on Climate Change (UNFCCC), green bond issuance should reach USD 1tn per year globally by 2020 in order to have a meaningful climate impact. This will require the green bond issuance in China to grow tenfold in just three years. For the China Green Bond Market 2016, addressing these issues is doable since technologies already exist as well as people’s awareness. The transition needs therefore a governmental support as well as from the private sector.

Green finance in China has become an inclusive system, gathering government policies and investments as well as private ones. China has taken the lead in green finance and has started the transition toward greener energy thanks to its government support, through both investments and regulations. But there is a need to harmonize domestic green finance frameworks with the international ones to guarantee the project greenness and the sustainability of the operator, as well as investors’ confidence and the green bond market expansion. Also, green finance in China needs to shift its investment from efficiency-based (such as coal-efficiency projects) to clean-energy ones in order to achieve international climate objectives and guarantee health safety regarding air pollution for instance.

To go further: Green Finance Initiative, City of London, Green Finance Committee & Renmin University of China. (2017). Greening the Belt and Road. http://greenfinanceinitiative.org/wp-content/uploads/2017/10/Greening-the-Belt-and-Road-English.pdf Accessed October 19, 2018.